Let’s use the Present Value (PV) calculation to record an accounting transaction.

On December 31, 2023, Instafix Co. performed a service for MedHealth, Inc. in exchange for a promissory note for $1,000 that will come due on December 31, 2026. The note does not specify any interest and there is no market for the note. The type of service performed by Instafix Co. is highly customized, meaning the fair market value of the service is not available. Instafix Co.’s accountant must record the transaction on December 31, 2023, keeping in mind the following:

To record the cash equivalent amount through a present value calculation, the accountant must estimate the interest rate (i) appropriate for discounting the future amount to the present time. The rate will reflect the length of time before the money will be received as well as the credit worthiness of MedHealth, Inc. Let’s assume that the appropriate rate is 10% compounded annually.

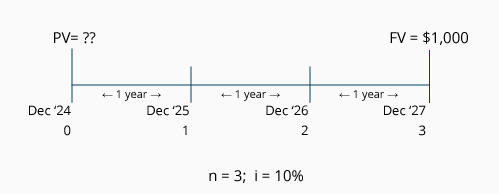

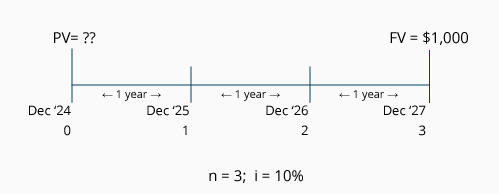

The following timeline depicts the information we know, along with the unknown component (PV):

As our timeline indicates, the length of time is three years, the interest rate is 10% compounded annually, and the future cash amount is $1,000. Let’s calculate the present value of this single amount by using a PV of 1 table:

Our calculation shows that receiving $1,000 at the end of three years is the equivalent of receiving approximately $751.00 today, assuming the time value of money is 10% per year compounded annually.

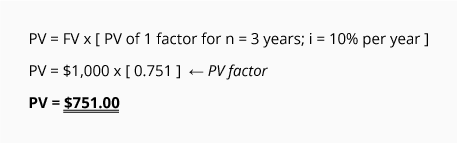

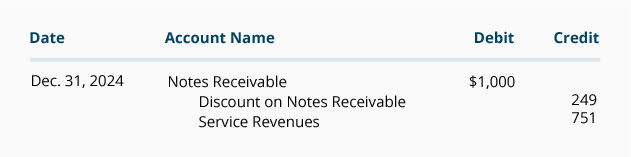

The cost principle (cash or cash equivalent at the time of the transaction) will be satisfied by recording the amount $751. The revenue recognition principle will also be satisfied, because only $751 has been earned (the amount associated with the services performed in December 2023). The $249 difference between $1,000 and $751 is interest that will be earned in the years 2024, 2025, and 2026.

Here is the entry the Instafix Co. accountant records on December 31, 2023:

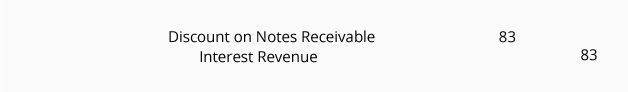

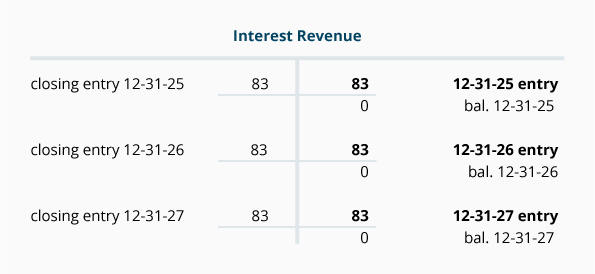

In the years 2024 through 2026, the Instafix Co. will record a total of $249 of interest revenue. If that amount is considered insignificant (with regards to the company’s total net income) the company could simply use the straight-line method to record $83 per year ($249 ÷ 3 years), as shown in the following journal entry:

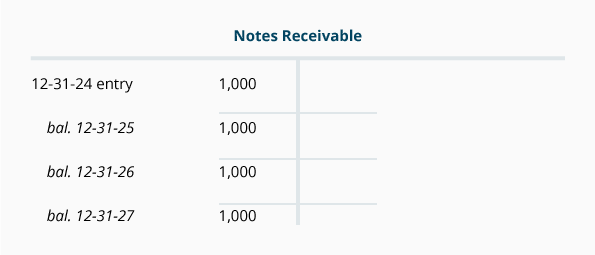

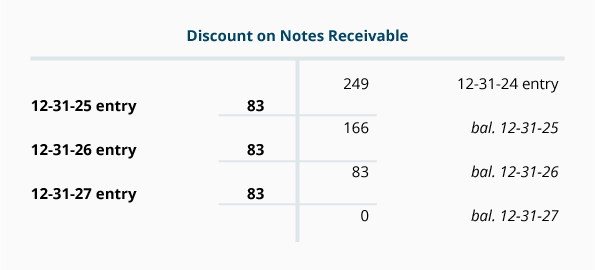

Over the years 2024 through 2026, the balance in Discount on Notes Receivable will move from a credit balance of $249 to a balance of zero. (Some accountants would describe this as amortizing the $249 balance to Interest Revenue over the life of the note.) At the end of 2026 and just prior to collecting the $1,000 due on the note, the carrying value of the note will be $1,000 (the $1,000 balance in Notes Receivable minus the $0 balance in Discount on Notes Receivable).

Effective Interest Rate Method of Amortizing the Discount

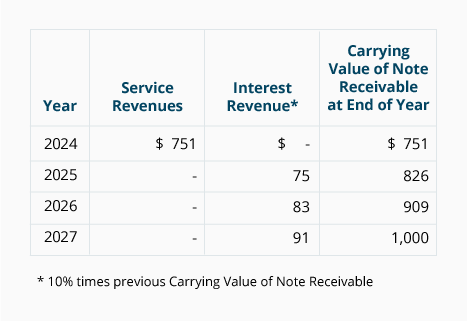

If, however, the $249 of interest is considered significant, then the amount of interest recorded each year should be determined by the effective interest rate method. Under this method, the amount of interest revenue recorded is directly tied to the balance (or carrying amount) of the note receivable. In other words, each year the interest revenue increases with the increase in the note’s carrying value:

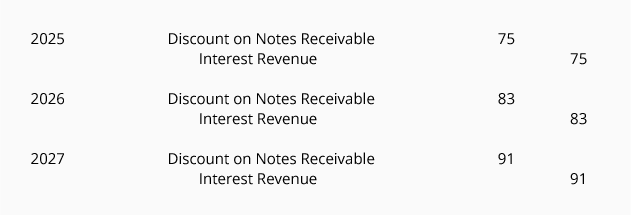

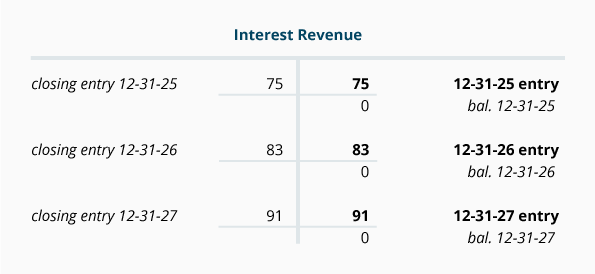

Using the effective interest rate method for interest earned, the journal entries to amortize Discount on Notes Receivable to Interest Revenue over the life of the note are as follows:

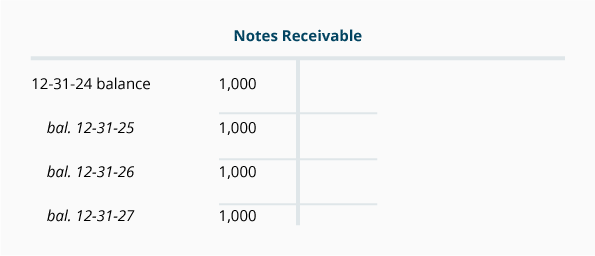

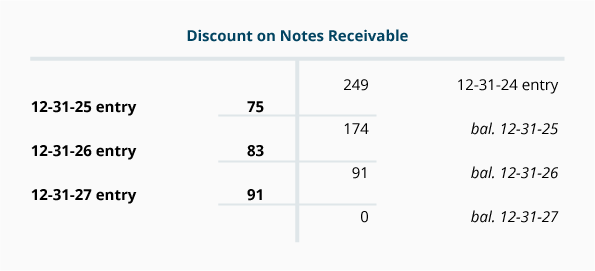

After posting these journal entries, the account balances will appear as follows:

The effective interest rate method must be used when the amount of the discount is significant. The reason for requiring this method of amortizing is to exhibit the logical relationship between the carrying value of the note reported on the balance sheet and the interest reported on the income statement.

Please let us know how we can improve this explanation

Submit Feedback No ThanksThe preferred method for systematically moving bond discount or premium from the balance sheet over to interest expense on the income statement over the life of the bond. This method is superior to the straight-line method of amortization, because it causes interest expense to be in tandem with the book value of the bonds. In other words, under this method bond interest expense on the income statement will decrease when the book value of the bonds decreases on the balance sheet. Bond interest expense will increase as the book value of the bonds increases. To learn more, see Explanation of Bonds Payable.

We recommend that you now take our free Practice Quiz for this topic so that you can…

Note: You can receive instant access to our PRO materials (visual tutorials, flashcards, quick tests, quick tests with coaching, cheat sheets, video training, bookkeeping and managerial guides, business forms, printable PDF files, and progress tracking) when you join AccountingCoach PRO.

You should consider our materials to be an introduction to selected accounting and bookkeeping topics, and realize that some complexities (including differences between financial statement reporting and income tax reporting) are not presented. Therefore, always consult with accounting and tax professionals for assistance with your specific circumstances.