How often have you faced the challenge of being stuck in a medical emergency while also worrying about getting the Health Plan claim settled? We hope that count is zero because that is what Bajaj Finserv Health aims to deliver. With our new Pre-authorization policy, we want to make your hospitalization & claim process experience less cumbersome and much faster.

As per the previous practice, if the hospital you choose to go to does not fall under the list of our partner hospitals, you would have to pay the charges out of your pocket first and then get reimbursed from us. If the hospital is listed as a partner hospital, then you are eligible for cashless payment.

As we are a growing network, we are yet to cover the complete span of hospitals that partner with us and this would lead to multiple reimbursement claim cases. To avoid this hassle for our consumers, now have a Pre-authorization feature for you.

With the Pre-authorization policy, if you happen to choose a hospital that is convenient for you or near your house but not listed as our partner, you can still avail cashless facility. All you have to do is, inform us one day from visiting the hospital and we will get our team moving to either include them in our network or make arrangements to let you avail the cashless facility. This will happen in a jiffy with the Bajaj Finserv Health app as shown below,

Screen 1: Why Pre-authorization is important

Screen 2: Explaining the Pre-authorization process

Screen 3: How the Pre-authorization process works

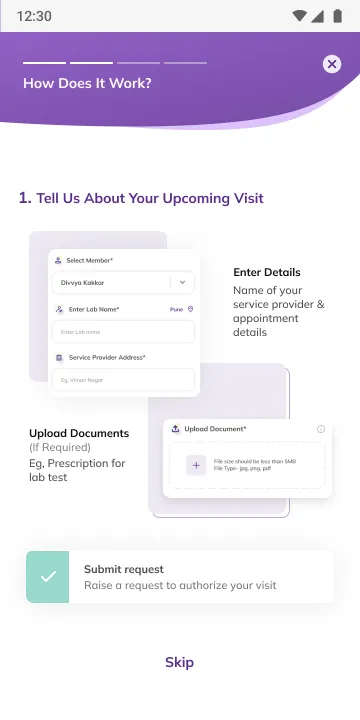

Screen 4: What you need to do?

Step 1: Enter details of the Hospital/Clinic you are about to visit and your appointment details

Step 2: Upload any relevant documentation if required

Step 3: Click Submit to authorize your visit and visit the provider without worry!

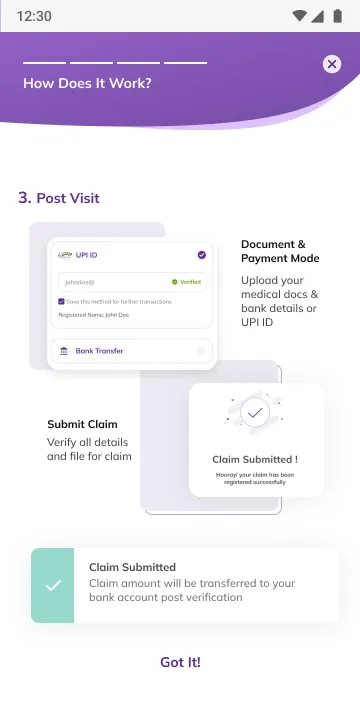

Step 4: Post your visit, submit your medical documents and bank details and claim amount reimbursed in a few days

As of today, a user goes to the hospital/doctor/lab without informing or taking prior approval from Bajaj Finserv Health and later files a claim directly. This can lead to the rejection of claims as sometimes these can have errors. With pre-authorization, you will have to submit the details of the hospital/doctor they are about to visit. Once the visit is authorized, you can go and visit the provider and then come back and file a claim. This will lead to fewer chances of claim rejection as you will be aware of what's included in your plan benefits before going to the provider.

Published on 23 Nov 2022 Last updated on 8 Feb 2023

References DisclaimerPlease note that this article is solely meant for informational purposes and Bajaj Finserv Health Limited (“BFHL”) does not shoulder any responsibility of the views/advice/information expressed/given by the writer/reviewer/originator. This article should not be considered as a substitute for any medical advice, diagnosis or treatment. Always consult with your trusted physician/qualified healthcare professional to evaluate your medical condition. The above article has been reviewed by a qualified doctor and BFHL is not responsible for any damages for any information or services provided by any third party.

Life and Health Insurance Policies: Key Differences

IVF Treatment: Is IVF Covered by Health Insurance?

How Health Insurance Premium Calculator Compares Premiums?

Best Private Health Insurance: Benefits and Factors

Benefits of Buying Term Insurance Plan

Having issues? Consult a doctor for medical advice